san francisco sales tax rate breakdown

News about San Diego California. Californias base sales tax is 725 highest in the.

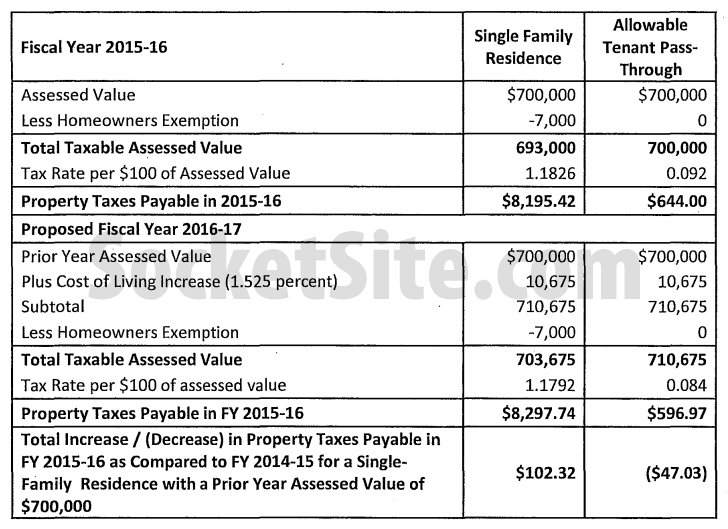

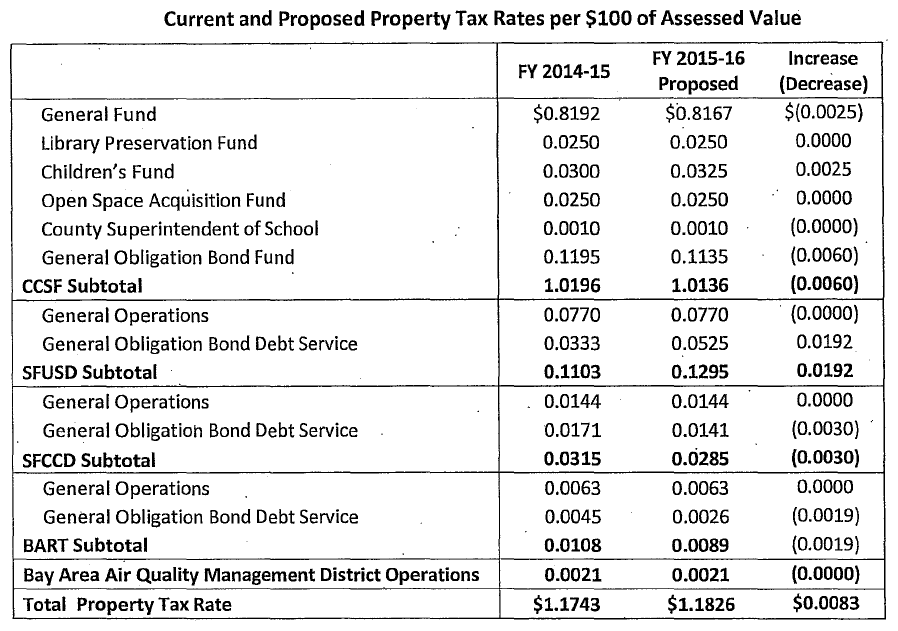

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

The California sales tax rate is currently.

. The penalty limit is 25 of the taxes owed. Case in point. The former proposal would have raised the sales tax rate in Santa Cruz by half a cent from 925 to 975 according to the staff report.

After getting the assessed value it is multiplied by the mill levy to determine your property. This perk is commonly known as the ITC short for Investment Tax Credit. Former City Manager Martín Bernal estimated the tax would.

Please use tax instead. We would like to show you a description here but the site wont allow us. Kelston Moore is a co-founder and co-CEO of Bad Boyz of Culinary a collective of local chefs building community and.

This tax does not all go to the state though. Eckerman Tax Services has tax return prices beginning at 55. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Pre-Owned Mercedes-Benz GLA at Mercedes-Benz of San Francisco. Sales Excise Tax. They even offer a.

All in all youll pay a sales tax of at least 725 in California. The California state sales tax rate is 725. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

San Francisco CA Sales Tax Rate. San Francisco has plenty of hidden costs though luckily weve broken them down for you. California Sales Tax.

Suite 2600 San Francisco CA 94105. San Francisco residents can expect to pay a minimum combined 85 sales tax rate. The company is headquartered in the Pacific Gas Electric Building in San Francisco CaliforniaPGE provides natural gas and electricity to 52 million households in the northern two-thirds of California from Bakersfield and northern Santa Barbara County almost.

Income refers to the mean third quintile US. We analyze millions of home sales to find real estate agents that sell homes faster and for more money. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials.

Ian Wright was the third employee joining a few months later. Here are some additional costs to consider in San Francisco. This is the total of state county and city sales tax rates.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in California. The ordertax attribute has been removed from order objects. Buy your next car 100 online and pick up in store at a Mercedes-Benz of San Francisco location or deliver your Mercedes-Benz to your home.

The three went looking for venture capital funding in January 2004 and connected with Elon Musk who contributed. The IRS typically docks a penalty of 5 of the tax owed following the due date. The rate and rate_percentage attributes are no longer included in order tax breakdowns please use the equivalent tax breakdowns in the orders line items.

Founded as Tesla Motors on July 1 2003 by Martin Eberhard and Marc Tarpenning in San Carlos California. Food and prescription drugs are exempt from sales tax. That rate is a uniform percentage varies by tax jurisdiction and could be any percentage below 100.

The current total local sales tax rate in San Francisco CA is 8625The December 2020 total local sales tax. You can certainly raise a family earning less. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

A town without a norm 224. In order to comfortably raise a family in an expensive coastal city like San Francisco or New York youve probably got to make at least 300000 a year. That is one bracing data point among the many in this book.

Bottom Line Bookkeeping and Tax in Salt Lake City UT offers a 99 tax return with full itemizing a 79 no itemizing return and a 35 student rate for high school and college students. San Francisco is a city where tolerance deteriorates into license. It gets a bit more complicated however.

Thanks to inflation 300000 or more may be required for you to live a middle-class lifestyle today. The sales tax rate can jump in other areas of the county. Finance or lease a used Mercedes-Benz.

There are about 25000 injection drug users in San Francisco a number 50 larger than the number of students in the citys 15 public high schools 43. The minimum combined 2022 sales tax rate for San Francisco California is. Price your home just right.

Morningstar rated the Lord Abbett National Tax Free Fund class A share 4 4 and 4 stars among 151 122 and 100 Muni National Long Funds for the overall rating and the 3 5 and 10 year periods ended 1312022 respectively. However it wont be easy if your goal is to save for retirement save for your. Income amount of 63218.

Here is the IRSs full breakdown of how much you can owe for missing a quarterly tax payment. If your taxable income is 496600 or. For each partial or full month that you dont pay the tax in full on time the percentage would increase.

That tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600. The state then requires an additional sales tax of 125 to pay for county and city funds. Our real estate blogs cover all topics related to residential real estate investing such as locating the best places to invest in real estate conducting investment property search performing rental property analysis finding top-performing investment properties choosing the optimal rental strategy traditional or Airbnb and others.

The minimum sales tax in California is 725. The San Francisco sales tax rate is. We used the percentage of income middle income rate spent on sales and excise taxes from WalletHubs Best States to Be Rich or Poor from a Tax Perspective report.

Get the best pricing strategies and negotiating tips and dont let the tax implications home appraisal process or all the packing scare you. There is no applicable city tax. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

Depending on local sales tax jurisdictions the total tax rate can be as high as 1025. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. The true state sales tax in California is 6.

The County sales tax rate is. Shop our used and certified pre-owned vehicles for sale in South San Francisco. The Pacific Gas and Electric Company PGE is an American investor-owned utility IOU with publicly traded stock.

The previously empty total_outstanding attribute has been removed from the order object. Therefore you will not be responsible for paying it.

Sales Tax Collections City Performance Scorecards

Data Shows Steep Drop In Sf Sales Tax Revenue Possible Decline In Population The San Francisco Examiner

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

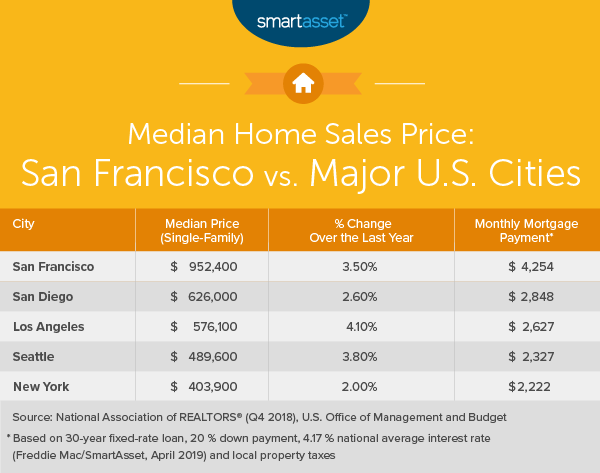

What Is The True Cost Of Living In San Francisco Smartasset

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Us Sales Tax On Orders Brightpearl Help Center

I Will Move To Silicon Valley And Earn 142k Year As Base Salary What Would My Monthly Take Home Pay Be After Taxes Quora